Somewhere in between the fast moving pace of innovative startups and the household names of the Fortune 1000 live the companies that generate over $10 trillion in revenue and employ more than 1/3 of all workers in the United States. The data and impact of these organizations are similar in Europe.

Welcome to the Mid Market. While definitions vary, the most common definition of mid-market firms are those organizations that have between $10 million and $1 billion in revenue, the sweet spot being between $100-500 million.

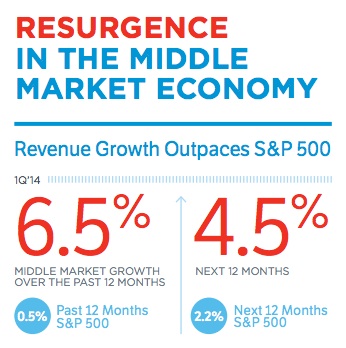

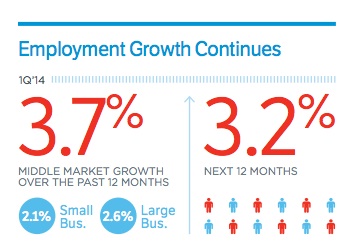

82% of these organizations are privately held and are responsible for a significant amount of earnings and employment growth as illustrated by the data below, compliments of the National Center for the Middle Market. Mid market firms outpaced the S&P 500 in revenue growth by 6% last year, and outpaced the job growth of small businesses and large enterprises by a significant margin.

The Coming Change

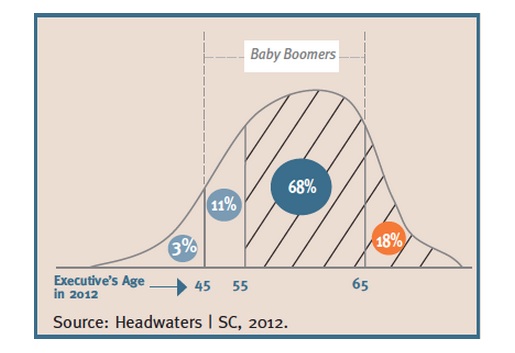

It’s been estimated that up to 75% of these firms will have new ownership over the next 15 years. While I don’t have hard research to back up that fact, there are indeed a growing number of aging baby boomers that will be looking to transition into their next phase of life. It is estimated that over 18% of current private owners are over the age of 66. The transition and evolution of mid market organizations will have a significant impact on the future of the economy. This transition will represent what some have called the largest transfer of wealth that the world has ever seen.

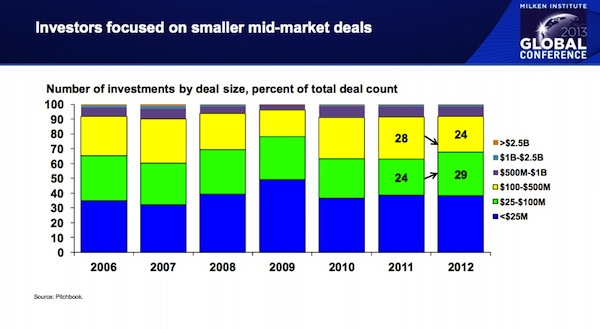

For the reasons above, the middle market is a hotbed of investment and M&A activity. It will continue to provide opportunity for many market participants, but may also lead to calamity as aging ownership fails to provide proper leadership for a networked age, and/or fails to properly transition their organizations into more capable hands.

Forging ahead and thriving

This isn’t to say that everyone is rushing towards the exit, waiting to be saved. Most of entrepreneurial owners have built solid, growing organizations that have stood the test of time. They grow partially because they have remained private and are able to keep their focus on the long term, without succumbing to the intense pressures of quarterly reporting as many public companies do.

When companies were asked recently in a survey by Deloitte “What factors influence your company’s decision to remain private for now?”, the number one answer far and away was “Desire for control and/or flexibility in decision-making”, with nearly 78% of respondents selecting that answer. A distant second was “Desire to keep financial information private” at 37.2%.

Many of these owners have long recognized the need for growth. In survey after survey, growing revenue is often mentioned as the top priority and challenge. GE Capital recognized several common themes among the top 9% of middle market companies, or those who have grown in excess of 10% a year.

Growth Leaders share five key strategic priorities

1. Focus on innovation: The strongest common theme is innovation. Continuous innovation is seen as their most important asset in competing with larger businesses. According to the survey, 54% of growth champions invest in innovation and new product development compared with 29% of the rest of the middle market. They also typically invest almost 2.5 times more in research and development per sales dollars than do lower growth middle market firms.

2. Strong management culture: A key focus for small companies transitioning to the middle market is developing management capabilities. This includes articulating a corporate vision, developing aligned business strategies and managing performance. Growth champions say — at twice the rate of other firms — that they have a diversified funding strategy in place, and 71% also believe they have a high- performing management team.

3. Sharp customer focus: Growth champions invest heavily in customer relationships to attract new customers and enter new markets. In fact, 62% consider themselves adept at attracting new customers compared to only 40% of other companies in the segment.

4. Exceptional talent management: Innovative career development and attractive compensation structures are hallmarks of successful middle market companies. About half of growth champions reported that they have access to a skilled workforce and the recruiting power to attract that talent; that compares to just 36% of the rest of the segment.

5. Broad geographic vision: Successful organizations clearly articulate the advantages of a broad geographic vision. In the U.S., 65% of growth champions are expanding from a local/ regional focus to the larger national market while only 39% of other middle market firms are doing so.

READ MORE ON GROWTH HERE: The Anatomy of Growth: Five pillars to fuel dynamic growth in your organization

Customers, technology, and talent

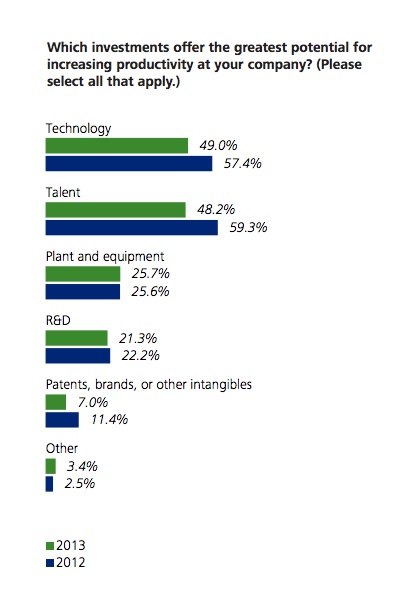

According to a recent survey by Deloitte, the focus of mid-market investment center around two things; technology and talent.

While talent has always been an area of focus, it is becoming more apparent that organizations are having more trouble finding the skill sets they need. In addition, technology is becoming more of a focus and perceived differentiator.

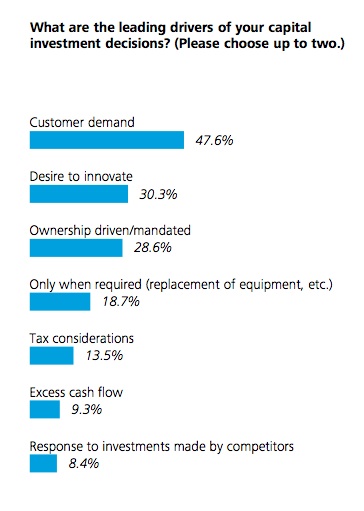

The convergence of Big Data, Analytics, Cloud, Mobile are rapidly changing the expectations of customers and employees, opening up new opportunities. Customer demand and innovation are driving these investments.

At the fulcrum of these investment dollars sits customer demand, as illustrated above. This fact was highlighted by this 2013 study by IBM “The Customer Activated Enterprise”.

(IBM Defines the mid-market as those organizations with between 100-1,000 employees)

The inevitable confluence of events presents great opportunities for investors, corporate leaders, and technology vendors to partner to drive innovation for the marketplace over the next decade. I’d love to hear more about your thoughts, experience, and questions.

| This post was provided as part of the IBM for Midsize Business program, which provides midsize businesses with the tools, expertise and solutions they need to become engines of a smarter planet. I’ve been compensated to contribute to this program, but the opinions expressed in this post are entirely my own and don’t necessarily represent, nor have they been influenced by IBM’s positions, strategies or opinions. |